More business buyers than ever – but what are they looking for in FY2025?

According to a report provided by ASX listed business sale platform, Seek Business, buyer enquiries have increased by more than 30% from FY23 to FY24.

For the regular person, buying a business has always been a relatively niche and lesser-known avenue for wealth creation, career fulfilment or investment. During & post COVID however, there seemed to be a general shift in the workforce’s attitude towards employment – mainly voicing concerns around a need for lifestyle autonomy and struggles with increased living costs.

Today, social media is awash with investment advice, wealth creation and business influencers, making entrepreneurship a more enticing and accessible avenue than ever. Buying an established business is not just for the big M&A experts anymore.

The Australian Small Business & Family Bureau recorded that 59% of SMB owners are over the age of 45, 19% of those being aged 60+. A large portion of these business owners will be looking to retire in the next 5-10 years, leaving well-oiled, profitable enterprises to the highly motivated next-gen.

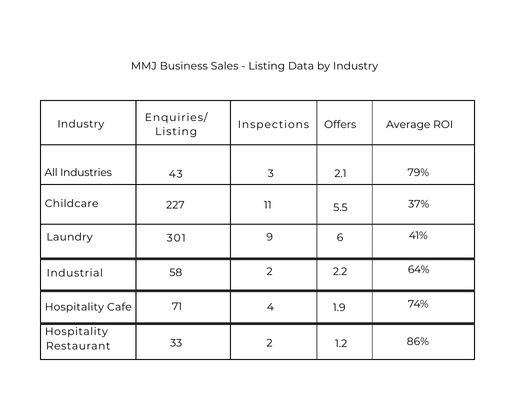

Awareness of the benefits of acquiring a business is growing, both for existing business owners and first-timers. But what exactly are buyers today looking for?

1. Childcare Centres – An Investors Playground

Reason for change in demand: The rising demand for childcare businesses is based on limited supply (regulatory hurdles slowing down start-ups) & growing demand to service increasing dual-income families. Government support in the form of the Child Care Subsidy (CSS) raised in July 2023 increased profitability in the sector, as well as ongoing apprentice subsidies and relatively low labour costs.

Who is buying: Mix of current childcare employees who have capped earnings potential in the industry looking to transition into ownership, and existing operators looking to add to their portfolio. The existing operators are more likely to be ready to inspect, make an offer and transact as they are usually better funded.

Buyers are looking for: 25-30% R.O.I., certified staff members in place, high-place centres & freehold.

2. Laundromats: The Unsuspecting Cash Cow Returns

Reason for Change in Demand: Encouraged by online influencers using platforms including podcasts, Instagram and TikTok a new wave of potential business buyers has been attracted to perceived passive/semi-passive business opportunities.

Who is buying: Young (under 40 years), first time business owners, family businesses, some competitor acquisition.

What are they looking for: Strongest demand is for passive investment i.e. laundromats – especially from younger buyers. Families or competitors will buy laundrettes/laundries with recurring commercial revenue e.g. from accommodation providers. Low R.O.I. ok.

3. Industrial/Engineering: Forging Ahead & Iron Solid

Reason for change in demand: Scarcity of industrial property, Customer stickiness

Who is buying: Strategic acquisition from competitor/owners in associated industries

What are they looking for: Customer contracts, recurring and growing revenue, team in place, freehold included, assets not requiring immediate replacement and low-moderate R.O.I

4. Hospitality: Starvation, Sustenance and Strategy

Reason for Change in Demand: Shortage of skilled staff, rising labour costs, career change still strong post Covid.

Who is buying: First time owners, some strategic acquisition with rebranding.

What are they looking for: Cafes preferred over restaurants due to simple operations with lower staff dependency. Buyers also looking for long lease (5+ years) with competitive rent/increases, quality fit-out, unique location, high ROI needed ideally 1-1.5-year payback. Also seeing strong demand for “Hospo-mat” style businesses e.g. frozen yoghurt retail, where customers largely self-serve to again reduce dependence on staff.