With first-home hopefuls set to face rising prices already in the housing market this year, the First Home Loan Deposit Scheme will offer help to a select number of buyers who may not have the backing of wealthy parents.

The scheme will allow 10,000 first-home buyers to purchase their first home each financial year with as little as a 5 per cent deposit, without incurring lenders mortgage insurance.

But with about 10 times that many first-home buyers in Australia every year, and interest already high, potential borrowers may need to move fast or risk missing out – and experts worry it could push up prices more.

As of Friday, 3000 first-home buyers have reserved a place under the scheme. So far 190 have been pre-approved, mostly single buyers with a median income of around $68,000. Minister for Housing Michael Sukkar welcomed the “strong initial interest”, adding smaller lenders will start offering the scheme from February 1 and another 10,000 spots will open from July 1.

Domain economist Trent Wiltshire is not surprised there has been keen interest in the scheme already.

“The scheme looks pretty popular, so the 10,000 places might run out pretty quickly,” he said.

Although it will be helpful to some individual buyers, he warned it was not a “silver bullet” to improve affordability.

“I think the scheme will put a little bit of upward pressure on prices at the lower to middle end,” he said.

“Any impact when prices are rising quickly is not ideal.”

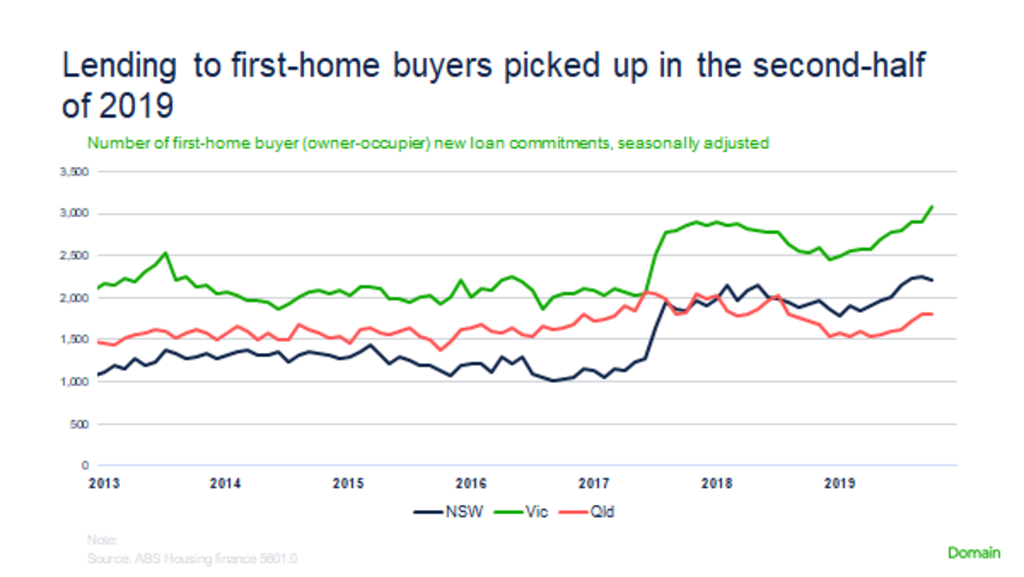

He expects first-home buyers to be active in 2020, trying to get into the expensive property market before rebounding prices rise too much, and take advantage of low interest rates.