When assessing the value of your business, it’s important to look beyond just the numbers on your balance sheet. Many owners focus solely on the book value of their assets—what’s recorded after depreciation—but this often misrepresents their true worth. While book value is useful for accounting, it doesn’t reflect what it would cost to replace those assets or what they might fetch on the open market.

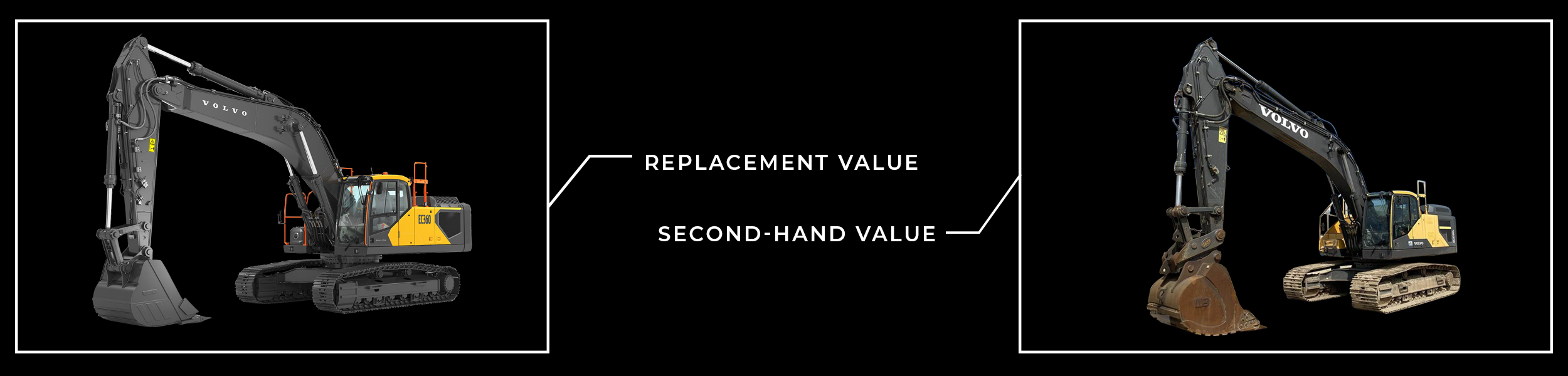

A more complete picture comes from considering replacement value and second-hand market value. Replacement value reflects the cost of acquiring new equipment, which is particularly relevant if you need to expand or replace aging assets. On the other hand, the second-hand market value provides insight into what buyers might actually pay for your assets today, which can impact your business’s attractiveness in a sale.

During the pandemic years supply chain issues led to considerable increases in the market price for second hand industrial vehicles and machinery. This has largely abated, and in some cases, there is now an oversupply of new equipment which has seen second hand equipment market value considerably reduce.

It is difficult to assess the market value of highly customised equipment or a retail/hospitality fit-out meaning business owners need to be flexible with their expectations. In general, the value of a fit-out will be heavily impacted by the performance and profitability of the current business. If you aren’t making above average profits with your current fit-out most potential buyers will be looking to renovate so will discount accordingly.

Another critical asset class for many businesses is stock. Whilst we are all familiar with the term stock at value (SAV) which implies inventory can be passed on to a business buyer at the price the existing owner paid. However, most buyers will seek proof that all stock is current and still part of the product offer.

Understanding these values can help you make informed decisions, whether you’re planning for growth, refinancing, or preparing for an eventual sale. As a general rule we would recommend regularly reviewing assets and stock and offloading anything which is not contributing to current business performance.

If you’d like to explore a fair market price for your business, which includes analysis of assets and stock, we’d be keen to have a chat. Let’s ensure you have the right information to maximize your business’s potential. Feel free to reach out to schedule a discussion.